The Real 50 Trillion National Debt Exposed

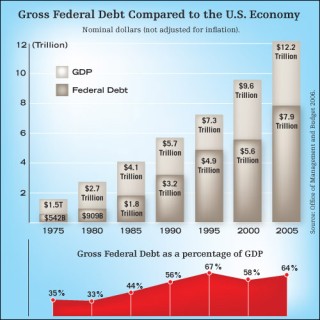

The Reported National Debt The Real American National Debt is not the 9 Trillion dollars reported, but a whopping 50 Trillion Dollars (below.) American media propaganda has never exposed the reality of the situation. The standard media reporting of the National Debt is as follows ... Faced with a potential government shutdown, the nation's debt limit was raised for the fourth time in five years. increasing the ceiling to $9 trillion. The increase to $9 trillion represents about $30,000 for every man, woman and child in the United States. Laurie Anderson - National Debt Dollar in Danger- The Greatest Threat to America Ready For Our Dollar To Completely CRASH Amero Watch Watch the complete Decline of the Dollar Video Series at ... *Dollar Decline Videos "When it comes to deficits, this president owns all the records," said Minority Leader *Harry Reid, D-Nev. "The three largest deficits in our nation's history have all occurred under this administration's watch." When Mr Bush took office he inherited a $236 billion budget surplus. Bill Clinton, his predecessor, had used budget surpluses to pay down some of the national debt in his last two years in office. Mr Bush also inherited some extraordinarily overoptimistic projections. When President Bush took office five years ago, the national debt was at $5.6 trillion; since then, big budget surpluses have collapsed into huge deficits, and the debt has shot up nearly 50 percent. The need to increase the debt limit yet again is a direct result of the fiscal policies and practices implemented by Bush and Congress over the past five years. Bush's tax cuts account for 30 percent of the debt limit increases required during his presidency. Revenue losses from a recession and new spending to combat terrorism and for the war in Iraq are also responsible.  Today the National Debt is 68 per cent of GDP (Gross Domestic Product). The largest employer in the world (United States Government), announced on Dec. 15 that it lost about $450 billion in fiscal 2006. Its auditor found that its financial statements were unreliable and that its controls were inadequate for the 10th straight year. On top of that, the entity's total liabilities and unfunded commitments rose to about *$50 trillion, up from $20 trillion in just six years. The Unreported Real National Debt (Not 9 Trillion but 50 Trillion) Though the Bush Administration's official budget lists the national debt and deficit as being incredibly high, they are actually far worse than reported, according to Rep. Jim Cooper (D-TN). But don’t just take his word for it, even if Cooper is a Rhodes Scholar and Harvard Law graduate. The following figures appear in the official U.S. Financial Report, released by the Treasury Department: * The true national debt is $50 trillion, not the $8.3 trillion Bush reported. That's $156,000 for every citizen, or $375,000 for every working American This figure has more than doubled in the past five years. We paid $327 billion last year on interest alone It's all getting worse In order to get the word out, Cooper reprinted the entire U.S. Financial Report in a book with his own explanatory introduction and a warning on the cover reading, "The Official Report the White House Does Not Want You To Read." He said the measure was necessary because the Administration tried to hide the report by distributing it to fewer than 20 members of Congress in the midst of the Christmas holiday season with no accompanying press release or media announcement.  What accounts for the huge discrepancy? Unlike businesses, the government uses "cash" instead of "accrual" accounting. This means that the government does not report future spending promises like Medicare and Social Security, or even future spending guarantees like veterans' benefits and federal employee pensions. "Cash accounting tells you what's in your bank account. Accrual accounting tells you what's in your bank account and what's on your credit card statement," Cooper told BuzzFlash in an interview. "Whether you're promising to buy a road or something at Target, you need to know what you promised to buy. That should be a binding obligation of the government. We've made a world of promises to folks that we need to keep." But wait, there's more! The U.S. Financial Report does not mention that if Medicare and Social Security are factored into the equation (which the Treasury Department did not), the true deficit was actually a whopping $3.3 trillion last year, over ten times more than Bush claims. And when Social Security projections are adjusted to reflect current life expectancies instead of the old 75-year mark, Cooper said the true national debt is "probably closer to $65 trillion." Worried that a new Democratic majority in the House would be blamed for the higher numbers in the future, Cooper has taken it upon himself to make it clear that the problem has already been created by Bush's failed economic policies. "This has to be announced on their watch, using their voice," he said. "There's a great urgency about this: we only have two months left to educate all Americans about how the Bush deficits are literally destroying America's credit." "I think [the report] is the most powerful critique of the Bush Administration" because they produced it, Cooper added. "No Republican can deny this attack." According to Cooper, conservatives won’t touch the issue because it would make Bush look bad, liberal newspapers think it's too confusing, and liberal politicians are worried the ensuing chaos from the higher numbers would limit social program spending. "The way we're going, we're going to have to eliminate programs," Cooper retorted. "Isn't it better to embarrass Bush while we can with his own words and to get Democrats in control?" Cooper said he is determined to do everything he can to add honesty to the federal budget. He gave the first copy of his book to House Democrat Leader Nancy Pelosi and has introduced legislation directing the president to use accrual accounting in his reports. A similar measure was recently lost in the Senate after passing in the House. Reference *Financial Report of the United States America has had a national debt since 1791, when it was $75 million. Today it rises by that amount every hour. USA's Biggest Creditors At present, foreign countries, central banks and other institutions hold more than one-fourth of the debt, but that percentage is growing rapidly. What worries many analysts is the amount of US debt financed by foreign governments and banks, particularly in Asia. The national debt is split between publicly held debt — money owed to US and foreign investors — and money owed to branches of the Government. Nearly half the publicly owed debt is held by foreigners. Japan is the biggest creditor, at $668 billion. China, the second-biggest, recently increased its stake by $40 billion to $263 billion. Unlike last year, when Congress passed a bill trimming $39 billion from the deficit through curbs to Medicaid, Medicare and student loan subsidies, Senate GOP leaders have abandoned plans to pass another round of cuts to so-called mandatory programs. If lawmakers continue to enact budget and tax legislation in the same irresponsible fashion that has marked the last five years, the debt will continue to explode. Even without factoring in the cost of the Iraq war and annual fixes to the Alternative Minimum Tax, the total national debt under current policy is expected to reach $11.5 trillion at the end of 2011, or twice that of the debt inherited by Bush when he took office.  Republicans Are the Big Spenders Red Republican Debt Increases - Blue Democratic Debt Increases 1776-1974, Republican Gerald Ford, Democrat Jimmy Carter, Republican Ronald Reagan, Republican George HW Bush, Democrat Bill Clinton, Republican George W.Bush (Republican Debt Increases Biggest In the History of the Planet) See *National Debt In the News Previous Civil Service Pension Fund Raids The Treasury Department had started drawing from the civil service pension fund to avoid hitting the $8.2 trillion national debt limit. The move to tap the pension fund follows the decision to suspend investments in a retirement savings plan held by government employees. The Treasury has leaned on federal employee retirement funds in past years when officials worried about a possible default on the national debt, and most federal employees take it in stride. Still, many employees object to the financial maneuvers, arguing that they amount to a raid on their personal accounts. Other Federal Raids, Lies, and Looting The Federal Government has been raiding and looting Social Security for over 25 years leaving behind IOU's. All the dollars that the government actually collects or spends are green. When the number of green dollars spent (whether on Social Security or defense) exceeds the number of green dollars received (whether from Social Security contributions or income taxes), the government has to borrow more green dollars from a real person somewhere. In fiscal year 2004, the federal government borrowed another $339 billion worth of green dollars from real people. But it pretended that it borrowed $595 billion blue dollars, and used that extra pretend blue debt to accumulate extra pretend red assets worth $256 billion for accounts like Social Security. The government could pretend to have borrowed or saved any quantity of blue or red dollars it wished, as long as they netted out to be the $339 billion green dollars which represent the underlying reality. Read more *Concerns About the Latest Social Security Proposal Social Security’s unfunded liability currently stands at $11.1 trillion ($700 billion more than last year), Read more *Social Security Facts vs. Myths What the Future Holds "What we do know for sure is that in the next decade the upward pressure on federal spending is going to be very, very large," says Ms. Rivlin, who also worked as President Clinton's budget director and is now at the Brookings Institution. "It's not so much the aging of the population as the fact that spending on medical care has been rising faster than GDP." "The bigger our debt becomes, the bigger the 'risk premium' that foreigners are going to demand," in the form of higher interest rates, says *Barry Eichengreen, an economist at the University of California, Berkeley. But if the president and Congress show signs of fiscal responsibility, "then foreigners will be reassured and the day of reckoning recedes." The bigger issue is how well America's fiscal health will hold up under the strain of costs associated with baby boomer retirements, which begin in just a few years. Taxes would have to be raised 50 percent to cover entitlement costs, says Glenn Hubbard, a former economic adviser to President Bush who is dean of the Columbia University business school. See *Debt Be Not Proud   Stumble It! Stumble It! |

Comments on "The Real 50 Trillion National Debt Exposed"

post a comment